The Argument for de-Dollarising with BRICS Currency

US President Donald Trump has refired conversations about a BRICS currency this week, following threats to ‘impose 100% tariffs’ on any nation from the emerging economic bloc. One-year ago, ahead of the 2023 BRICS Summit held in Sandton, the topic of a BRICS currency was well and truly put to bed when economic experts explained the sheer complexity of such an undertaking.

However, this hasn’t stopped President Trump from threatening emerging nations once again for seemingly no reason. Currently, the BRICS core nations include: Brazil, Russia, India, China and South Africa. While a ‘BRICS Plus’ group: Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates were invited to join the cluster. So, where does talk of a BRICS currency come from and how would it work?

BRICS CURRENCY EXPLAINER

The idea of a unified BRICS currency could, in theory, reshape global economics. It would represent a significant geopolitical mechanism to reduce dependence on the United States dollar. The theory behind it is to create a more balanced international financial system globally. Of course, Donald Trump and the United States does not want to see such a thing happen. Hence, the threat of 100% tariffs on any participating BRICS nation, reports Business Tech.

However, looking at it objectively, the five core BRICS nations represent approximately 40% of the world’s population. Made up primarily by China and India, it represents nearly 30% of global Gross Domestic Product (GDP). With this in mind, should a BRICS currency ever materialise, it certainly has the gravitas to challenge existing monetary structures. It could also eliminate the threat of sanctions, currency fluctuations, as well as high tariff and transaction costs with the US.

HOW MIGHT IT WORK?

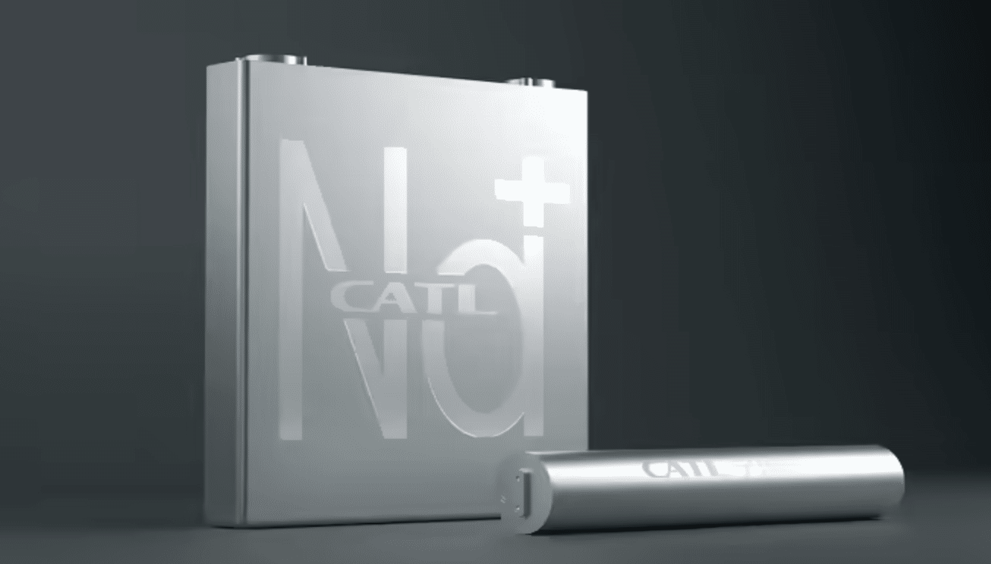

A proposed unified BRICS currency could function through multiple mechanisms. One approach involves creating a digital currency backed by a ‘basket’ of member currencies. This is similar to how the International Monetary Fund (IMF) works. Another model, while more complicated, might involve an actual physical currency with standardised valuation mechanisms. This would necessitate an exchange rate between member nations to maintain a consistent baseline value.

Another could involve a digital, crypto-type currency. As a result, blockchain and advanced digital management would provide a critical backbone. The benefit of the latter would include rapid trading, secure cross-border transaction and side-stepping traditional banking institutions. Economists suggest that the success of a BRICS currency would depend heavily on:

– Stable exchange rates.

– Robust economic cooperation between member states.

– Comprehensive regulatory framework.

– Widespread trust and acceptance of the new monetary system.

– Significant political will and economic alignment to overcome pressures from the US.

POTENTIAL PITFALLS

However, as we’ve already seen from President Trumps rhetoric this week, a BRICS currency will undoubtedly risk heightened geopolitical tensions. The US dollar has dominated global trade for decades. In turn, this has allowed the US significant economic leverage globally. Policymakers in Washington see a BRICS currency as a direct challenge to their economic hegemony. And the US will discourage other nations from adopting or recognising the new currency through harsh economic and political means.

Emerging countries feeling constrained by existing financial systems might genuinely find a BRICS currency an attractive option. It could free up international trade and accelerate a mindset shift away from US dollar. Trump’s stance, ironically enough, could rekindle a multipolar approach to global economics. With emerging economies hoping for greater autonomy and representation in global financial systems. Who knows, this may indeed be part of President Trump’s plan to divide and conquer …

Ray Leathern

The South African

English

English