Brics’ Daringly Autonomous Model for Financial Sovereignty

In the rarefied world of economic policy-making, where the public and markets are distanced from complex decision-making, communiqués serve as windows into the ambitions, hesitations and geopolitical leanings of powerful economic blocs. Released in October 2024, three influential documents from Brics, the International Monetary Fund’s International Monetary and Financial Committee and the World Bank’s Development Committee each offered a distinct view of the global economic landscape.

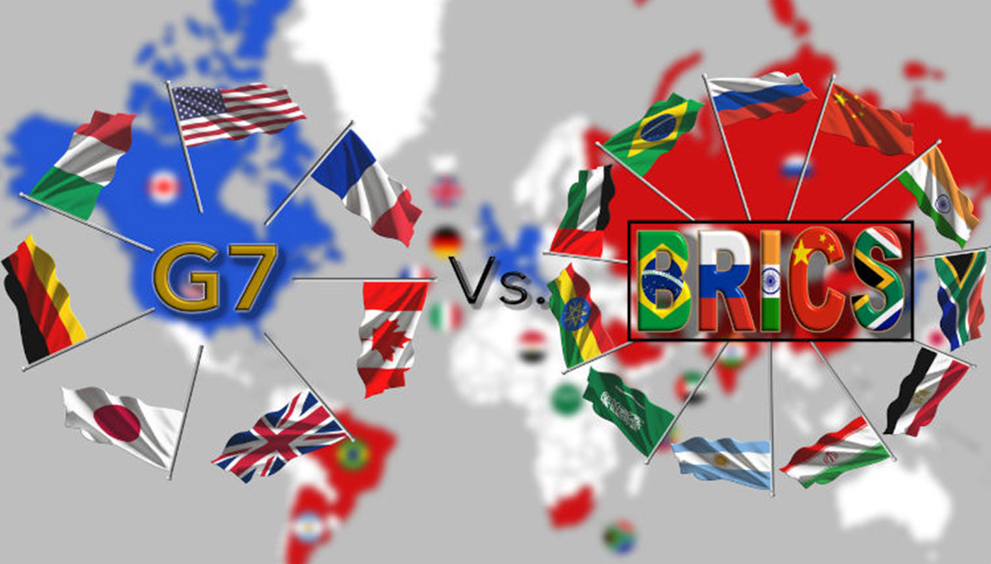

While the IMF and World Bank communiqués aim to reinforce established frameworks and shape policy discourse, Brics presents an alternative vision. With an expanded bloc representing over 32% of global gross domestic product and projected by the IMF to control one-third of global output by 2028, Brics is asserting its place in global growth dynamics.

This enlarged group now includes the founding five – Brazil, China, India, Russia and South Africa – alongside the newly admitted Egypt, Ethiopia, Iran, Saudi Arabia (as an invited country) and the United Arab Emirates. Through a dense 134-point communiqué, the Brics bloc articulates its stance on economic and financial sovereignty with increasing clarity and determination.

This latest vision from Brics could be read as an intent to gradually dismantle or, at the very least, challenge the long-standing post-second world war frameworks governing international monetary and financial systems. Or perhaps, more moderately, it signals a loud call for fundamental reform – seeking an ‘inclusive and just’ international financial architecture that better serves emerging and developing economies. Underlying this demand is a palpable distrust in the current system and how global policies are decided.

Are the paths outlined in the IMF and World Bank communiqués and the Brics declaration truly so divergent? Do they not all, in some sense, seek continuity within change or is the world moving towards an institutionalised, bifurcated economic order?

Multipolar sovereignty

The Brics declaration envisions a multipolar financial system that stands free from the dominance of traditional international monetary structures. Central to their vision is prioritising regional autonomy and financial sovereignty, which directly challenges established global payment systems, such as Swift.

At the heart of this strategy lies the Brics cross-border payments system designed to facilitate transactions in local currencies, reducing reliance on dominant international currencies (once sterling and now the dollar) and the extensive dollar-centric financial infrastructure. This move aims to shield participating nations from the potential ‘weaponisation’ of reserve currencies and geopolitical pressures.

In contrast, the IMFC communiqué underscores the value of the existing monetary and payments system, reinforcing its role as a stabilising force amid global economic uncertainties. Acknowledging challenges like inflation, rising debt and geopolitical tensions, the IMF’s message remains one of cautious continuity, emphasising stability over transformation.

Double alignment

With its rapidly growing economic influence and expanded membership, Brics is increasingly positioning itself as an alternative voice and a formidable player with the potential to reshape the international financial order.

However, the dual memberships of many Brics countries in other global economic bodies, including the IMF, World Bank, Financial Stability Board and G20, create a strategic positioning dilemma. Rather than pursuing an exclusive alignment, Brics members may engage in ‘double alignment,’ where they balance the benefits of dollar stability while exploring pathways to financial independence. This delicate balancing act raises the question of whether Brics, as it expands, can maintain cohesion amid diverse national interests and priorities.

For instance, Brazil and India’s nuanced positions – supporting regional co-operation within Brics while remaining committed to Western trade ties – highlight the bloc’s internal diversity. While Russia and China advocate for rapid de-dollarisation and the creation of parallel financial systems, India favours a more measured approach that preserves its integration with global markets. These internal divergences underscore the complexities of Brics’ mission and raise questions about its ability to drive systemic change in the international financial order.

The three communiqués reveal fundamental policy divergences across four critical areas: macroeconomic stability, debt sustainability, climate finance and financial infrastructure.

Macroeconomic stability and debt

Both Brics and the IMFC/Development Committee acknowledge the growing pressures on emerging economies, aggravated by escalating debt servicing burdens. The IMF’s response has been to expand concessional lending through the Poverty Reduction and Growth Trust – a vital mechanism to support vulnerable economies within the existing dollar-centred monetary framework. The IMF’s coordination with the World Bank’s International Development Association fund replenishment also seeks to provide structured financial support with attached policy conditions, reinforcing a framework prioritising policy continuity and fiscal discipline.

In contrast, Brics aims to expand the reach of its New Development Bank, which provides loans with fewer policy conditions. The appeal of the NDB lies in its flexibility, enabling countries to retain control over their development agendas without the rigorous reforms often mandated by IMF and multilateral lending. By including new members like Egypt, Ethiopia and the UAE, Brics signals a commitment to building an alternative financing model that champions policy sovereignty and gives developing nations more agency in their development pathways.

Climate finance

Ideological differences also surface on the issue of climate finance. While both Brics and the IMF/World Bank emphasise the importance of climate action, their approaches diverge markedly. The IMF’s communiqué promotes a standardised, multilateral approach, channelling resources through frameworks that align with global climate targets and metrics. For instance, the World Bank’s pledge to double agri-finance commitments by 2030 aims to enhance climate resilience in agriculture through globally standardised frameworks and metrics.

In contrast, Brics supports a decentralised model via the NDB, allowing member nations to fund climate projects tailored to their national needs. Countries like India and Brazil argue that standardised frameworks can overlook emerging economies’ unique priorities and capacities. Brics’ flexible approach to climate finance empowers countries to align investments with their specific developmental paths, avoiding a one-size-fits-all model often favoured by multilateral institutions.

Financial infrastructure

One of the most ambitious initiatives in the Brics communiqué is a cross-border payment system designed to operate independently of Swift. This effort emphasises the bloc’s frustration with advanced markets’ control over global financial infrastructure, which Brics countries view as susceptible to geopolitical pressures. The bloc seeks to foster financial autonomy by promoting regional trade in local currencies and reducing exposure to the dollar-dominated system through initiatives like the Brics Interbank Cooperation Mechanism and a proposed Brics Reinsurance Company.

Meanwhile, the G20 is advancing its own vision for cross-border payments reform. In collaboration with the IMF, World Bank and Financial Stability Board, the G20 has outlined a roadmap focused on enhancing the existing payment system. Unlike Brics, the G20 initiative aims to incrementally improve the current system through technical upgrades, prioritising faster and more transparent cross-border transactions while continuing to use Swift (at least for now). This divergence represents two competing visions: Brics’ push for a multipolar financial infrastructure versus the G20’s aim to strengthen and modernise the current dollar-centred system.

Navigating a bifurcated financial landscape

The 2024 communiqués from Brics, the IMF and the World Bank represent two diverging visions for global finance. While Brics promotes a multipolar model grounded in financial autonomy, the IMF and World Bank remain committed to continuity within the existing frameworks. As the stakes increase, the influence of these statements – often fraught with contradictions and ambiguous messages – creates uncertainty for investors and policy-makers alike. This unpredictability is unsuitable for global markets or investment flows, particularly when international coherence is needed to address fragile economic growth and mounting social challenges.

For those who monitor the fine print of these communiqués, the messages conveyed can be at odds: a Brics advocating for regional sovereignty, a G20 emphasising cohesion and an IMFC endorsing stability. Yet, without a governance structure that holds these bodies accountable for consistency – especially given the significant overlap in member countries – this fragmented communication risks exacerbating global financial instability. Such inconsistencies sow confusion when both democracy and capitalism are under critical scrutiny, making it essential to communicate a unified approach to pressing global challenges.

As we anticipate further statements from the 11th G20 and COP29 in November 2024, the global financial community will be watching to see whether common ground emerges in areas like sustainable development, trade, climate finance, financial stability, cross-border payments and digital finance. These discussions could pave the way for a more harmonious global economic order or underscore an increasingly divided landscape. While Brics’ calls for a multipolar world may appeal to many developing countries, the entrenched dollar-based system remains a stabilising force that cannot be overlooked. How these bodies address and articulate their differences could determine whether the world heads towards co-operation or confrontation in the coming years.

Udaibir Das is visiting professor at the National Council of Applied Economic Research, senior non-resident adviser at the Bank of England, senior adviser of the International Forum for Sovereign Wealth Funds, and distinguished fellow at the Observer Research Foundation America. He was previously appointed at the Bank for International Settlements and the International Monetary Fund.

OMFIF

English

English